Millennials, Generation X, Baby Boomers may approach life differently, but they all place one goal above the rest when it comes to money: saving for retirement. This may be evidence of trying to make up for tough financial times about half of the respondents feel retiring at age 65 is not as realistic today as it was 10 years ago.

The sentiments was greatest among millennials 60% said they would sacrifice their retirement savings to support their kids.

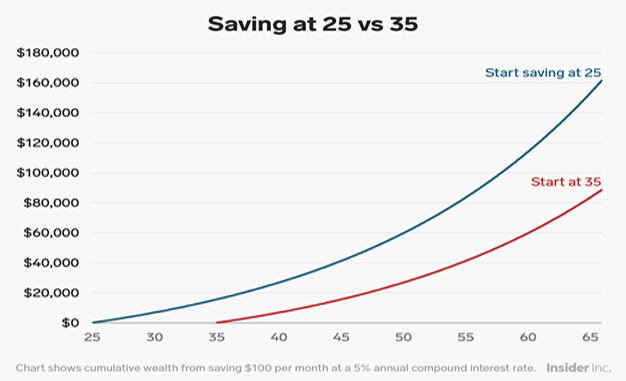

The respondents had investable assets of at least $100,000, and more than 700 were millionaires. Choosing the right place to save can make an even bigger difference. Saving and investing through a tax-advantaged retirement account, such as an IRA or 401, can give your money an even greater boost. The most common types of retirement accounts may tax your money differently.

If you choose to stash away money in a Roth 401 or IRA, your money will grow tax-free. But it seems there’s one thing even more important to some of the survey respondents than preparing for retirement. One in four people said they would delay, or already have delayed, retirement to help their children pay for college. Hope isn’t lost if you missed the boat in your 20s.

Starting to save now, wherever you are in your timeline, is better than starting tomorrow or next week. It takes great patience to build wealth and there’s no replacement for lost time.

Recent Comments