There are an endless number of books, podcasts and talking heads that will sell you on their methods for gaining financial freedom. Telling someone to start saving early is like saying you should exercise for your long-term — advice from Captain Obvious.

If you are a business owner, you should have your plan analyzed and benchmarked against low cost alternatives. In fact, as the plan sponsor you have a legal obligation to do so but most don’t. You can request a copy of your employer-fee disclosure and this will itemize your fees. If you are an employee, you can request a copy of the employee fee disclosure from your existing provider.

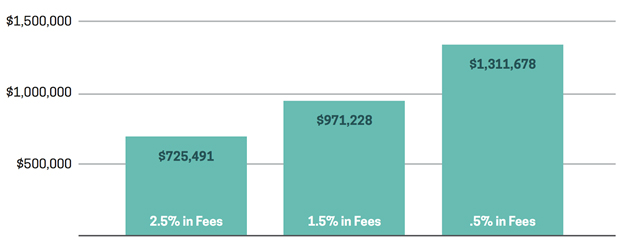

The chart below shows the impact of excessive annual fees.

Sure, nothing in life is free but, as you can see, getting your annual fees as low as reasonably possible is crucial. How does one know how much they are actually paying given that the Department of Labor says over $17 Billion is lost in hidden fees each year (somehow hiding fees is legal, which is another discussion for another time)? Let me summarize a short list of do’s and don’ts that should greatly serve you in your journey: Start saving early and do whatever it takes to catch up (and automate it so you don’t even think about it).

1. Start saving early and do whatever it takes to catch up (and automate it so you don’t even think about it).

2. Avoid excessive fees.

3. Avoid any advisor who is paid commissions or is otherwise incentivized to sell you a particular investment.

4. Avoid chasing expensive actively managed funds and stick with low-cost index funds.

5. Don’t buy expensive life insurance as an investment tool.

6. Be tax efficient! Max out your tax-advantaged accounts first.

The path to financial freedom might be narrow but only because most people have wandered off on their own or been steered in the wrong direction by a “professional.” Keep this list as your map, and I encourage you act now.

Recent Comments